estate tax changes in 2025

When the TCJA doubled the estate tax exemption in 2018 the changelike most changes in that legislationcame with an expiration date. No Changes to the Current Gift and Estate Exemption Provisions Until 2025 The 117M per person gift and estate tax exemption will remain in place and will be increased.

The Tax Cuts And Jobs Act Key Changes And Their Impact Bny Mellon Wealth Management

California tops out at 133 per year whereas the top federal tax rate is currently 37.

. This increase expires after 2025. In this case on Jan. In 2026 the current estate and gift tax exemption also known as the unified tax credit will be cut almost in halfand maybe more if Congress eventually succeeds in their.

After 2025 the limit is scheduled to drop to 35 million but even then very few estates. Yahoo Finances recent article IRS Says Millionaires Can Keep Estate Tax Benefits After 2025 says that the exemption increase was a big priority for Republicans in the 2017 tax overhaul. Multi-family home built in 1923 that sold on 08062018.

How did the tax reform law change gift and estate taxes. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions. Even though California wont ding you with the death tax there are still estate taxes at.

With inflation adjustments the exemption is. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

Second the federal estate tax exemption amount is still dropping on January. That means individuals this year can pass on tax-free 114 million from their. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026.

Estate Tax Exclusion Changes Now and in 2025 Jan 28 2022 - News Press Releases Sharon D. Estates with valuations over 6 million will see an additional tax of 40 of the difference between roughly 6 million and 12 million. The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted.

Because the BEA is adjusted annually for inflation the 2018. The TCJA temporarily increased the BEA from 5 million to 10 million for tax years 2018 through 2025 with both dollar amounts adjusted for inflation. 15000 in 2021 The estate tax exemption was set at 5 million in 2011 adjusted for inflation.

Estate Tax Exclusion Change Now and in 2025 Uncategorized Sharon Ravenscroft Wednesday 26 January 2022 240 Hits The estate tax exclusion has increased to 1206. At a tax rate of 40 thats a 72 million tax bill. The proposal seeks to accelerate that.

The tax reform legislation raised the estate tax exemption to 1118 million per person and 2236 million per married couple for 2018. View 1 photos for 2025 Meridian Ave South Pasadena CA 91030 a 7 bed 3 bath 2605 Sq. It could potentially be signed in a different form where the proposed revisions are brought back in.

The current estate tax exemption limit is 117 million up from 1158 million last year. After that the exemption amount will drop back down to the prior laws 5 million cap. Additionally in 10 years the gift.

The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for. The current estate and gift tax exemption is scheduled to end on the last day of 2025. The estate tax is imposed on bequests at death as well as inter-vivos.

On the other hand if you held onto those assets and you passed away in 10 years a large portion of the 1964 million would be taxed at 40. The tax reform law doubled the BEA for tax-years 2018 through 2025. The TCJA doubled that exemption for 2018-2025.

Starting January 1 2026 the exemption will return to 549 million. That was a significant increase over. 115-97 doubled the exemption levels.

The tax revision of 2017 PL. The 2017 Republican tax law approximately doubled the estate and gift tax exemption. Ravenscroft The estate tax exclusion has increased to 1206 million.

How The Tcja Tax Law Affects Your Personal Finances

2020 Estate Planning Update Helsell Fetterman

How The Tcja Tax Law Affects Your Personal Finances

How Could We Reform The Estate Tax Tax Policy Center

Gifting Time To Accelerate Plans Evercore

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

Historical Estate Tax Exemption Amounts And Tax Rates 2022

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

2019 Estate Planning Update Helsell Fetterman

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Could We Reform The Estate Tax Tax Policy Center

Historical Estate Tax Exemption Amounts And Tax Rates 2022

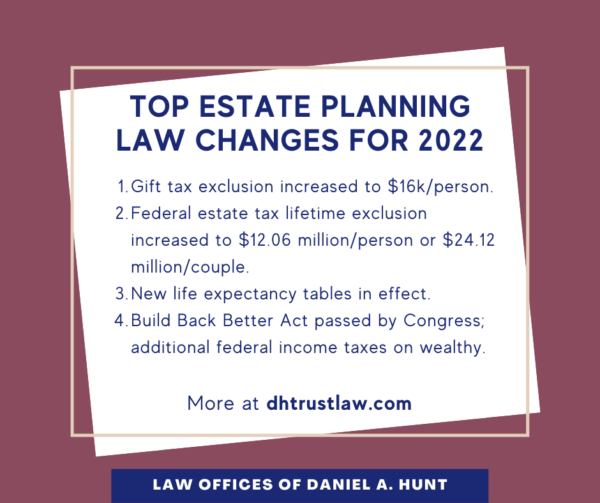

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Final Regulations Confirm No Estate Tax Clawback Center For Agricultural Law And Taxation